Looking for a licensed payday loan in BC? Whether it’s a car repair, a medical bill, or a gap before payday, it’s important to understand the rules that protect you — and how Cash Stop Loans makes borrowing simple, secure, and compliant with Consumer Protection BC.

What Is Consumer Protection BC?

Consumer Protection BC is the provincial authority that regulates payday lenders in British Columbia. They ensure lenders follow strict rules around fees, transparency, and borrower treatment, so you know exactly what you’re getting into.

Why Licensed Lenders Matter? Working with a licensed lender means you’re protected. It ensures:

1. Fair lending practices

2. Transparent fees and repayment terms

3. Clear communication about your loan

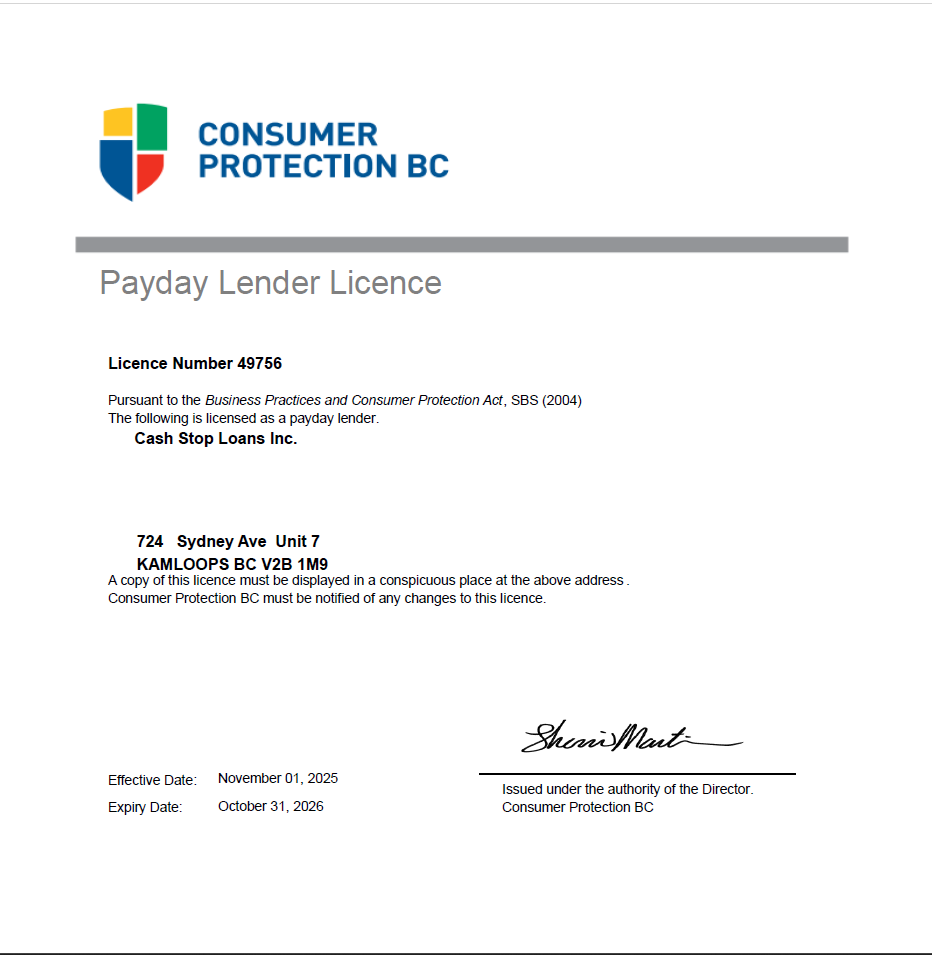

At Cash Stop Loans, we’re proudly licensed and operate fully under BC law.

How Much Can You Borrow? BC has strict payday loan limits:

Maximum loan amount: $1,500

What Does It Cost?

BC also protects borrowers from runaway interest rates. The total cost of a payday loan is capped at:

$14 per $100 borrowed. That’s it. No hidden fees.

Know Your Rights as a Borrower

Payday lending in BC is regulated for a reason. You have rights, and lenders like us are required to honour them.

Rather than listing every detail here, we encourage you to explore the full rules and borrower protections on the Consumer Protection BC website: https://www.consumerprotectionbc.ca/

This helps you make an informed decision – and keeps our relationship clear and transparent.

Why Cash Stop Loans?

We’re not just fast – we’re fair. Here’s what sets us apart:

1. Licensed in BC, Fully compliant with Consumer Protection BC

2. Secure online applications – Apply from home, no appointments

3. Fast approvals – Get funds in 30 minutes

4. Clear terms – Total cost and repayment date shown upfront

5. No judgment, just help – We’re here to guide, not pressure

Ready to Apply?

Need a short-term financial solution from a lender you can trust? Choose Cash Stop Loans, BC’s secure and responsible payday loan provider. Apply online now and take the next step toward financial relief with full confidence.