Can You Get a Loan While on Disability?

If you’re receiving disability benefits and need short-term financial help, you may be wondering if a loan is even an option. The good news is

If you’re receiving disability benefits and need short-term financial help, you may be wondering if a loan is even an option. The good news is

Today, on International Women’s Day, we proudly celebrate Cash Stop Loans as a women-owned and operated company. From day one, our journey has been

When you’re in a financial pinch, finding a short-term loan or payday loan can feel overwhelming. You need cash fast, but not all lenders are

Borrow Smarter with Short-Term Loans: Avoid Costly NSF Fees Managing unexpected expenses or bridging the gap between paydays can be challenging, especially when your bank

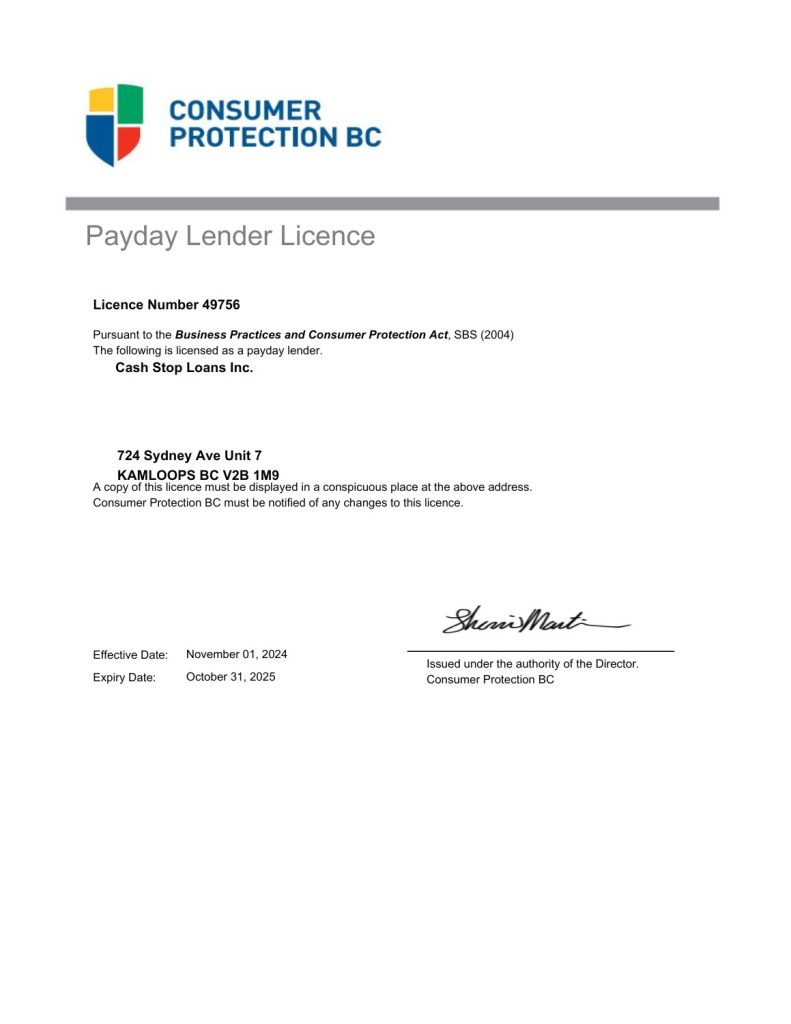

British Columbia Residents: The maximum charges permitted in British Columbia for a Payday Loan is 14% of the principal. We charge $14 per $100 borrowed. On a $300 loan for 14 days, the total cost of borrowing is $42, with a total payback amount of $342 and an APR of 365.00%. BC License #49756.

Maximum charges permitted in British Columbia for a payday loan: 14% of the principal

We charge: 14% of the principal

Maximum charges permitted in British Columbia for a payday loan: 14% of the principal

We charge: 14% of the principal

For a $300.00 loan for 14 days:

Total cost of borrowing = $42.00

Annual Percentage Rate =365% per year.

This information meets the requirements of the Business Practices and Consumer Protection Act.

License Number: 49756

Maximum charges permitted in British Columbia for a payday loan: 14% of the principal

We charge: 14% of the principal

Maximum charges permitted in British Columbia for a payday loan: 14% of the principal

We charge: 14% of the principal

For a $300.00 loan for 14 days:

Total cost of borrowing = $42.00

Annual Percentage Rate =365% per year.

This information meets the requirements of the Business Practices and Consumer Protection Act.

License Number: 49756