Understanding Payday Loan Rules in BC: What Every Borrower Should Know

Looking for a licensed payday loan in BC? Whether it’s a car repair, a medical bill, or a gap before payday, it’s important to

Looking for a licensed payday loan in BC? Whether it’s a car repair, a medical bill, or a gap before payday, it’s important to

If you’re receiving disability benefits and need short-term financial help, you may be wondering if a loan is even an option. The good news is

Today, on International Women’s Day, we proudly celebrate Cash Stop Loans as a women-owned and operated company. From day one, our journey has been

When you’re in a financial pinch, finding a short-term loan or payday loan can feel overwhelming. You need cash fast, but not all lenders are

Borrow Smarter with Short-Term Loans: Avoid Costly NSF Fees Managing unexpected expenses or bridging the gap between paydays can be challenging, especially when your bank

Maximum charges permitted in British Columbia for a payday loan: 14% of the principal

We charge: 14% of the principal

Maximum charges permitted in British Columbia for a payday loan: 14% of the principal

We charge: 14% of the principal

For a $300.00 loan for 14 days:

Total cost of borrowing = $42.00

Annual Percentage Rate =365% per year.

This information meets the requirements of the Business Practices and Consumer Protection Act.

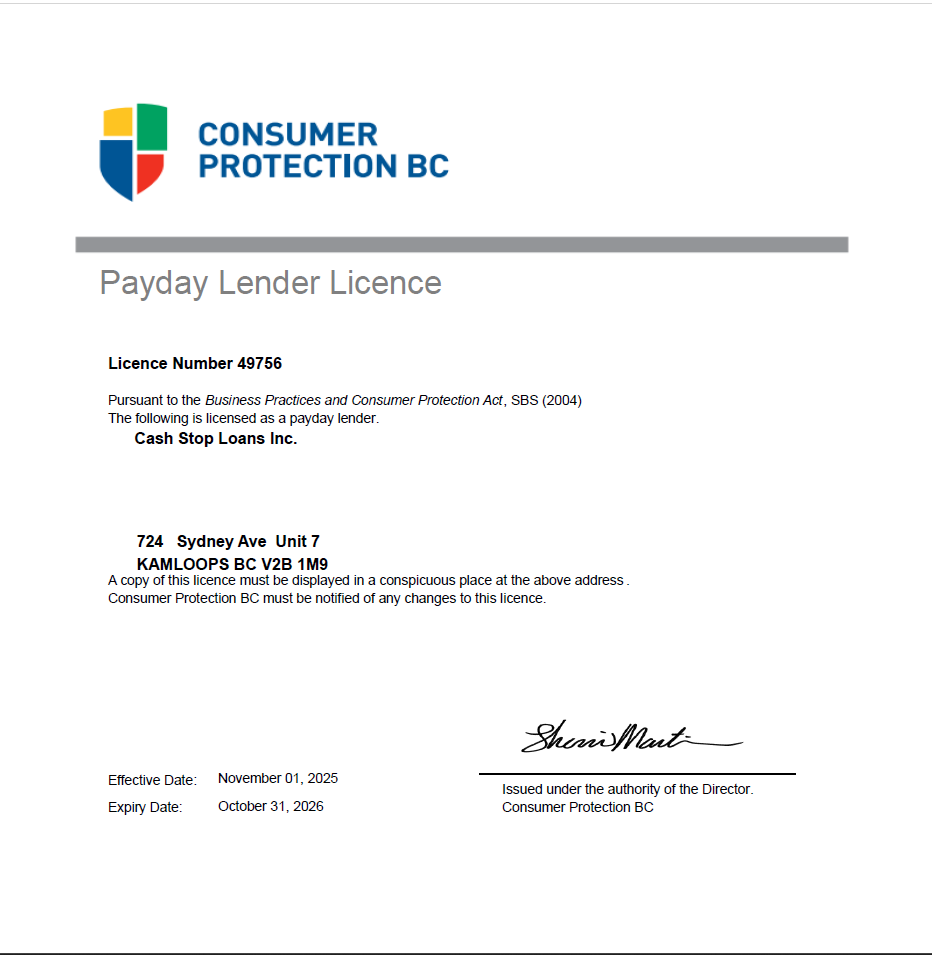

License Number: 49756

Maximum charges permitted in British Columbia for a payday loan: 14% of the principal

We charge: 14% of the principal

Maximum charges permitted in British Columbia for a payday loan: 14% of the principal

We charge: 14% of the principal

For a $300.00 loan for 14 days:

Total cost of borrowing = $42.00

Annual Percentage Rate =365% per year.

This information meets the requirements of the Business Practices and Consumer Protection Act.

License Number: 49756